OVERVIEW

Mokxa leverages advanced Artificial Intelligence (AI) technology to give Third-Party Administrators (TPAs) a competitive edge in the industry. By overcoming perception issues, safeguarding profits, building trust, and retaining clients, Mokxa helps TPAs stay ahead of their competitors in a rapidly evolving market.

Padmanabha “PSB” Bhatta | October 29, 2025

Two-star or lower reviews can ruin a high-value deal and lead to lost customers.

Bad online customer reviews and ratings are more than just a public image problem—they directly hurt competitiveness. Employers may initially consider cost and efficiency, but perception quickly shapes both factors. Low scores suggest inefficiency or poor service.

Why Reputation Matters

“Bad ratings also break trust, reduce broker support, and harm TPAs, who often already have low margins.” — Elaine Harkins, VP, Healthcare Business, Mastercard

The Mastercard CDH white paper1 reveals that plan sponsors want transparency, predictive insights, and forecasting capabilities, not just administrative support. Weak perception exposes skill gaps before any request for proposals (RFPs). The Self-Insurance Professionals Benefit Association2(SPBA) also states that employers value service and quick responses as much as price.

Studies show that 82% of healthcare clients read reviews before making a choice, and 68% change providers based on reviews (Reputation.com Healthcare Consumer Survey3).

These actions also influence B2B decisions—brokers and employers view low ratings as a risk, which extends sales cycles and leads to higher discount demands.

Cost of a Star Drop

Losing one star can significantly reduce a TPA’s chances of being selected. It may also result in 5–10% more discounts being demanded. For a TPA with $50 million in annual claims, this translates to $2–$5 million in lost revenue each year. Ratings of three stars or less prompt one in four employers to reconsider renewals, and brokers are hesitant to recommend low-rated TPAs.

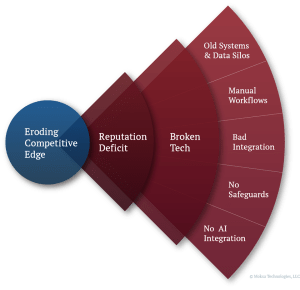

What’s Broken—Customer Pain Points

Weak perception comes from common frustrations:

Each problem reduces trust among employers, brokers, and sponsors, increases costs, raises the risk of client loss, and harms competitiveness.

Root Cause Tech Issues

- Old Systems & Data Silos → No live updates, constant catch-up

- Manual Workflows → More errors, slow claims, weak growth

- Bad Integration → Weak links with insurers, payroll, and HRIS

- No Safeguards → Missed SLAs, compliance risks

- No AI Integration → Appeals and complaints take more time and cost more

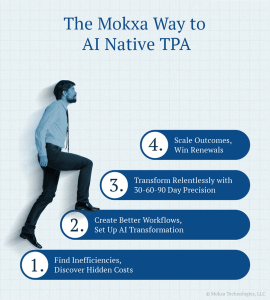

The TPA Transformation Playbook

At Mokxa, we use a method called The Mokxa Way—moving TPAs from broken processes and negative perception to smooth operations and measurable results.

Expert Speak

The Mokxa Way transforms TPA ecosystems from patchwork processes into intelligent,

interoperable systems where every integration, automation, and safeguard drives outcomes.

Padmanabha “PSB” Bhatta

Chief Customer Success Officer

interoperable systems where every integration, automation, and safeguard drives outcomes.

Padmanabha “PSB” Bhatta

Chief Customer Success Officer

Four Elements of Transformation:

1. Find Inefficiencies, Discover Hidden Costs

TPAs identify the obvious problems—claims delays, enrollment errors, and billing messes—but overlook silent ones, such as split teams, hidden risks, and overreliance on certain experts. These cut profits and trust.

Action Steps:

- Conduct workshops with leaders to identify previously unaddressed issues.

- Audit workflows to find hidden costs.

- Compare with peers to spot gaps.

How Mokxa Helps:

- By turning hidden issues into clear priorities for leaders.

2. Create Better Workflows, Set Up AI Transformation

Redesign workflows for a digital, AI-enabled TPA. Mokxa works with clients to build strategies that utilize real-time data flow across claims, billing, HR, and providers—eliminating service gaps.

Transformation Pathways:

- Robotic Process Automation (RPA): Automate repetitive, rules-based tasks such as ID card generation, eligibility checks, and billing reconciliations.

- Intelligent Process Automation: Redesign high-friction workflows, such as appeals, grievances, and onboarding, to reduce error rates and enhance transparency.

- Agentic AI: Deploy AI agents to triage, route, and analyze cases, freeing staff from routine decisions while staying within compliance guardrails.

- Human-in-Loop Augmentation: Keep people in workflows where judgment and accuracy are mission-critical—such as claims exceptions or compliance reviews.

- Generative AI Personalization: Deliver proactive, personalized communications to employers and members (e.g., claim updates, SLA alerts, tailored reports).

Action Steps:

- Map current workflows and friction points.

- Prioritize redesign opportunities where AI reduces errors and increases transparency.

- Pilot low-code automation alongside live operations.

- Develop a phased AI adoption roadmap spanning RPA to Generative AI (GenAI).

How Mokxa Helps:

- By deploying tailored AI solutions, we enhance operational precision, ensure greater visibility, and reinforce employer confidence.

3. Transform Relentlessly with 30-60-90 Day Precision

Execution requires discipline. Mokxa builds a 30-60-90-day plan that tackles the most business-critical fixes first. Using its AI-enabled rapid integration fabric (Joget), Mokxa deploys automation fast, connects legacy systems without disruption, and activates GenAI and AI agents for communication, triage, and anomaly detection.

Action Steps:

- 30 days: Automate routine tasks such as ID cards generation, eligibility verification, and billing reconciliations.

- 60 days: Implement intelligent automation for handling appeals and grievances, where AI agents triage cases and escalate only those requiring human attention.

- 90 days: Expand GenAI-enabled communication features—including claim updates, SLA notifications, and customized employer reports—and introduce integrated KPI dashboards.

How Mokxa Helps:

- By ensuring that every milestone produces visible improvements, which restore confidence in employers and brokers.

4. Scale Outcomes, Win Renewals

Long-term growth depends on proving value. Mokxa aligns operational KPIs—such as claims accuracy, SLA compliance, and onboarding accuracy—with reputation metrics like Google ratings, NPS, and CSAT. Results are turned into competitive differentiators in bids and renewals.

Action Steps

- Build KPI dashboards tied to employer and broker expectations.

- Benchmark your performance against competitors to demonstrate a competitive edge.

- Train teams to use metrics not only for continuous improvement, but also to generate meaningful business insights that guide smarter decisions.

- Use proven outcomes as case studies in renewal and sales cycles.

How Mokxa Delivers:

- By tying key performance metrics to reputation indicators, driving consistent results, and turning efficiencies into measurable business success.

Efficiency to Reputation: The AI Advantage

AI-based transformation isn’t just about speed; it also improves reputation. Automation and AI enhance accuracy, expedite SLA resolution, and bolster the brand’s image. Faster responses and clear updates build trust with clients, making renewals and growth easier.

The Mokxa Way Delivers Success for TPAs

Mokxa’s quick, results-focused, affordable AI Transformation Framework helps TPAs achieve clear improvements in service quality, operational consistency, and client satisfaction.

Expert Speak

AI transformation doesn’t have to be slow or expensive. Mokxa proves it can be fast, focused, and measurable.

Padmanabha “PSB” Bhatta

Chief Customer Success Officer

Strengths:

- Speed: AI solutions delivered in weeks.

- No disruption: Improve workflows without stopping work.

- Confidence: Proven delivery of AI-enabled transformations.

- Proof: Delivered to multiple TPAs, enabling quick onboarding, high ROI, increased productivity, faster policy creation, and quicker rate sheet processing. View Success Stories

Mokxa’s team combines TPA expertise with tech skills to enhance cost savings, trust, and competitiveness.

Proven Experience in TPA Transformation

Mokxa has a strong track record of helping TPAs gain a competitive advantage. With deep expertise, Mokxa optimized workflows, cut onboarding time, and improved accuracy. Example with Allied Benefit Systems:

- 2,000 groups onboarded in just 6 weeks.

- 27% ROI in the first cycle.

- 50% increase in administrative productivity.

- 75% faster policy document creation.

- 10x faster rate sheet generation with version control.

These results demonstrate Mokxa’s ability to deliver scalable AI solutions that enhance TPA competitiveness and reputation. See the Complete Success Story.

Ready to Compete Smarter?

Mokxa specializes in AI solutions for TPAs. For cost reduction, error minimization, and success in the upcoming enrollment season, Mokxa offers the fastest, most reliable path.

👉 Start chatting with Mokxa’s TPA Alpha Agent now!

Get instant assistance and discover how we can help you compete more effectively, scale up, and achieve a truly successful transformation.

References:

- Mastercard CDH White Paper, Employer Insights on TPAs and Consumer-Directed Healthcare

- The Self-Insurance Professionals Benefit Association

- Reputation.com Healthcare Consumer Survey

- Healthcare Reputation Report, 2021

- Valuepenguin.com, 2025

- Repugen, 2024

- Reputation.com, 2024

- Clarity Benefits, 2023

- Benefitnews, 2024

- AdminaHealth

- Duco / Financial Technologies Forum